Facebook brings conversation-based pricing to WhatsApp Business

Next year, WhatsApp will switch to a conversation-based pricing model for its Business app, charging companies per customer interaction. Could this model be the solution to its monetisation problem? And what can telcos learn about this value or outcome-based approach?

Since purchasing WhatsApp from founders Jan Koum and Brian Acton in 2014 for $19 billion, Facebook has struggled to monetise the messaging service, short of charging users for making calls and sending messages in defiance of the app’s original mission statement.

That goal is now one step closer, as Facebook has announced that WhatsApp Business will adopt a new, conversation-based pricing model from next February, charging businesses on a per conversation basis rather than the number of messages sent.

WhatsApp was originally free to use for the first 12 months, after which it would charge users a $1 annual subscription fee, however this model was dropped in 2016. It was Koum and Acton themselves who first suggested charging businesses to send messages to their customers through the app, while incumbent executives at Facebook pushed for ads as the means to monetise the service. The two founders soon resigned from the company, with Acton going on to invest $50 million in rival encrypted messaging app, Signal.

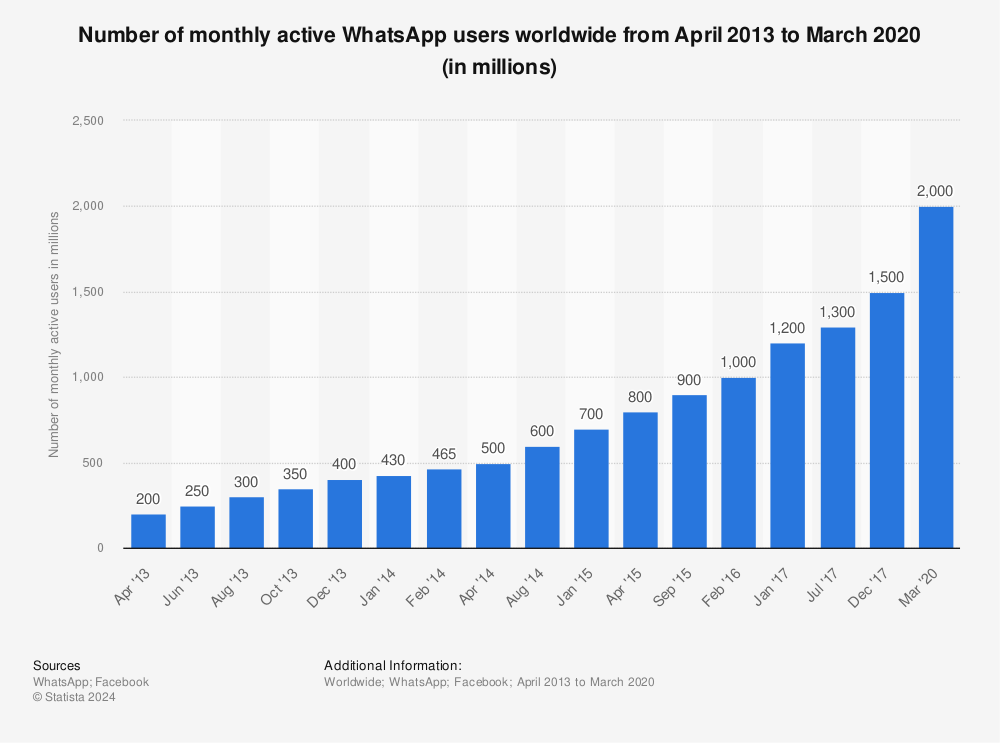

Despite the app’s controversial new privacy update which has led many users to flock to alternative, encrypted messaging apps, including Signal, the number of WhatsApp users continues to grow:

The WhatsApp Business App is free to use, but the new WhatsApp Business API (WABA) will include paid access to the API for businesses. The first 1,000 conversations each month are free, and there is no charge when a user messages a business using a call-to-action button. However, once above the 1,000 conversation threshold, they will be priced at two different rates: one for user-initiated conversations, such as customer support inquiries; and the other for business-initiated, such as post-purchase notifications and promotions.

The Business API provides access to message templates – pre-written, quickly deployed messages, such as confirmations, updates or reminders. These messages can include enhanced content, for example images, videos and files sent by the business to help users, who can in turn send their own screenshots or videos to help in customer support cases.

Message templates are essential for sending messages outside of the “service window,” a 24-hour period in which businesses can respond to customer requests, beginning when the first message is delivered (either by a user or the business). Once the service window closes, the business must use another template message to initiate contact with customers once again, triggering another conversation charge and starting a new 24-hour period.

And this is what makes this pricing model really interesting – by shunning a traditional usage-based pricing model where every individual message would be charged, WhatsApp are focusing on how the Business API is being used and the value it delivers. It’s an outcome-based model that businesses can relate to - a single conversation or session should be enough to complete a customer service request and it’s not unreasonable to cap this period at 24 hours. Business users can focus on their customer experience, without worrying about how many messages back and forth it may take to deal with a request.

This is a lesson that all CSPs can learn from, pricing based on where value is delivered and not just counting or charging for everything consumed. Another organisation that has worked this out is Zoom, who offer a free service for one-to-one video calling, but the real value for businesses comes with multi-party video conferencing, and this is what customers pay for.

WhatsApp is clearly developing its monetisation strategy, not just by charging businesses to send messages to customers instead of ads, but it also has big ambitions around e-commerce too. The company has recently appointed the former Amazon executive responsible for Amazon Pay as their head of payments in India, home to 15 million of its 50 million WhatsApp Business users, as it looks to launch its proprietary payments system in the country.

WhatsApp e-commerce is especially lucrative in the developing world, where Facebook plans to allow companies to list products for sale, take orders, and accept payment for those orders through the app. China’s WeChat, a collaboration between Alibaba and Tencent, has already proven the success of this model, handling a total of $17 trillion in mobile transactions in 2017.

With Facebook looking to integrate messaging functionalities between its flagship apps, tying WhatsApp’s 2 billion users to the wider Facebook/Instagram ecosystem could be essential to Facebook’s push into e-commerce, while finally making the most of its biggest untapped source of revenue.