Telco revenue growth: key drivers, competitive dynamics

As the telecoms industry searches for new sources of revenue, CSPs face mounting pressure to innovate while maintaining operational excellence. As emerging technologies and complex business models reshape the landscape, how can telcos drive sustainable revenue growth?

The telecoms industry is facing unprecedented challenges, with declining revenue from traditional communications services and opportunities for growth in new markets often stifled by organisational culture, legacy systems and inefficient processes.

To remain relevant and competitive, CSPs must strike the right balance between operational excellence, to protect their existing lines of business, and innovation, to capitalise on new network and service capabilities.

The successful integration of advanced technologies, the development of innovative new service offerings, and the ability to navigate the complexities of B2B, B2C and B2B2X business models, will all be crucial in determining the long-term success of the industry.

So what are the key drivers of revenue growth and the transformative technologies that will be vital for telcos to maintain a competitive edge?

The B2B conundrum

B2B is gaining much greater focus and momentum, particularly in areas such as IoT, security and cloud. These services have seen robust growth, albeit from small beginnings, as SMEs, enterprises and public sector organisations increasingly seek to digitalise operations and enhance their cybersecurity measures, with CSPs often seen as a trusted brand and a one-stop-shop for these businesses.

One of the key questions for CSPs is whether to run B2B on a separate BSS/OSS stack or if B2B and B2C can both operate successfully on the same platform. The answer depends very much on the flexibility of their existing systems – success requires high levels of automation for mass market services, whilst retaining the ability to negotiate and deliver bespoke services and solutions for high value B2B clients.

CSPs that are hamstrung by legacy systems will clearly benefit from implementing a new digital BSS/OSS to support their B2B ambitions. However, those who can run both business lines on one convergent platform will have the upper hand in the long run - this capability not only streamlines operations but also allows CSPs to offer integrated solutions that address the needs of both consumer and enterprise customers, and provides the means to deliver B2B2X services or “X-as-a-Service”.

Looking ahead, new B2B opportunities are emerging around GenAI with CSPs having the potential to help enterprises harness its power for competitive advantage. AI-infused products can be provided to help businesses automate processes, gain insights from vast amounts of data and improve decision-making, while AI services can be offered to help enterprises with AI model training and deployment.

APIs and platform business models

An emerging opportunity for telcos lies in the monetisation of APIs. By exposing network capabilities to third-party developers, CSPs can create new revenue streams and foster innovation within their ecosystems; they can offer APIs that allow developers to integrate connectivity into smart devices, creating value-added services that generate additional revenue.

This ability to monetise network capabilities is becoming a core platform capability for telcos, opening the door to new “Network-as-a-Service” offerings. And as trusted brands, they can create marketplaces for customers to access these new connected services, leveraging their BSS/OSS platforms to generate new revenues.

A centralised product catalogue, combined with flexible charging and billing mechanisms, allows CSPs to experiment with pricing models and monetise a wide range of services, including cloud, network slicing and edge computing.

The smart city opportunity

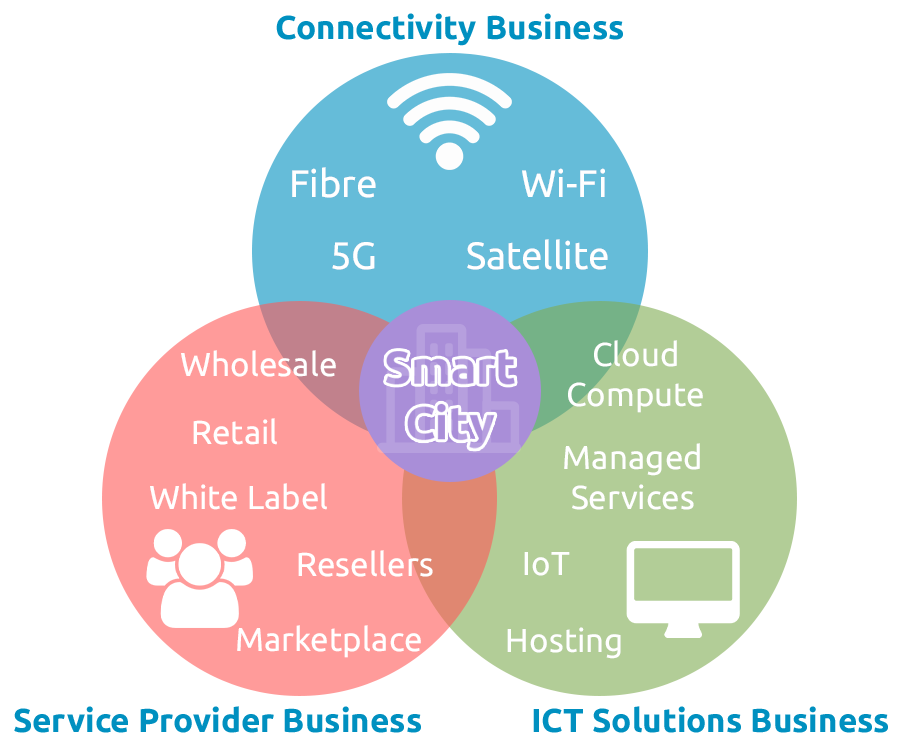

Smart cities are perhaps the ultimate opportunity for telcos to showcase their “techco” credentials – digital connectivity, data-driven decision-making, automation and integration of various domains, underpinned by high-speed, low latency networks and a vast collection of IoT devices and sensors. In a smart city, civic authorities can centrally manage and optimise various municipal facilities at a very granular level – from utilities and public connectivity, to transport and environmental monitoring – all powered by the CSP.

By positioning themselves as key enablers of smart city initiatives, telcos can create new revenue streams by providing essential services such as cloud hosting, analytics and white label “as-a-Service” offerings to other city service providers – for example, Identity-as-a-Service, Platform-as-a-Service and Billing-as-a-Service.

This can all be delivered through modern BSS/OSS solutions, with a unified catalogue and charging engine for all customer types, service types, business models and payment methods.

The agility advantage

One of the most important factors influencing revenue growth is agility.

Smaller CSPs, altnets and MVNOs have often outpaced incumbents in bringing new services to market, leveraging their flexibility and responsiveness to meet changing consumer demands. This agility is particularly evident in markets where consumer preferences are rapidly evolving, and digital-native competitors capture market share by offering more innovative services.

Unburdened by the heft of complex legacy systems and organisational inertia, new entrants can experiment with business models and technologies and quickly pivot to launch innovative services, such as digital entertainment, mobile payments and cloud-based solutions. This has allowed these providers to gain a competitive edge, challenging the dominance of the industry's traditional players and capturing significant market share.

For incumbents, the challenge lies in transforming their operations and reinventing their culture so they can compete against digital brands.

The role of BSS/OSS modernisation

To be successful, CSPs must modernise their BSS/OSS to streamline operations, boost customer satisfaction, and improve their ability to launch new services fast.

AI and automation undoubtedly have key roles to play, not only in reducing operational costs and improving service delivery, but also in launching and scaling new services. After years of talking about adopting a “fail fast” approach to competing with the digital services providers (DSPs), AI provides the means for CSPs to do exactly that.

Integration with AI can significantly improve customer relationship management, service delivery and revenue assurance, and open up vast amounts of customer data for rigorous analysis to identify trends, personalise service offerings and predict churn.

CSPs must also keep their options open to cope with the uncertainties of tomorrow. This is where BSS/OSS-as-a-Service really pays off, allowing them to focus on their goals and KPIs, with regular software updates and the ability to easily consume the operational services they need to drive their business plans forward. Furthermore, standards-based software with Open APIs and an Open Digital Architecture simplifies integration and allows adaptation and evolution of their BSS/OSS stack without systemic change.

As customer expectations continue to rise, the ability to innovate quickly and efficiently monetise new network capabilities will be a key differentiator in the industry. By adopting low-code/no-code platforms with AI-driven analytics, automation and composable digital experiences, CSPs can enhance service delivery, maximise customer engagement and create new opportunities for revenue growth.

Read more in the TM Forum report Telco Revenue Growth: Is B2B a Beacon of Light?