Top Telecoms Trends for 2024 Revisited

Now that we’re around halfway through the year, we return to the predictions made by the Cerillion team in January for the top telecoms industry trends. From AI and B2B self-service, to satellites and altnets, how are the predictions holding up so far?

For our annual look at the top telecoms industry trends, we quizzed several members of the Cerillion team as to what technologies and strategies they thought would define 2024.

The year was off to a bad start as an air of “quiet desperation” hung over MWC with the industry continuing to play second fiddle to big tech and AI. Now six months in, we revisit some of the bright spots for the sector, as chosen by us, to see which are proving to defy the doom and gloom.

Artificial Intelligence

The biggest development in AI news over the last six months has been the launch of GPT-4o, bringing sophisticated speech and multimodal capabilities to the ‘bot.

This hype was quickly lost in translation when actress Scarlett Johansson began legal proceedings against OpenAI, accusing them of using an “eerily similar” sound-alike of her after she previously declined to give them permission to use her voice.

Johansson previously voiced an AI chatbot in the 2013 film Her, which OpenAI CEO Sam Altman made reference to in a tweet shortly after GPT-4o’s reveal, scuppering any notion that it’s all a coincidence and underscoring the continuing criticisms of generative AI as being built on the unattributed work of others.

Meanwhile, doomerism persists as AI scientists continue to warn that the advancing tech spells trouble for humanity. In “Managing extreme AI risks amid rapid progress”, a cohort of scientists including Geoffrey Hinton recommend the need for safety frameworks and tougher requirements should the technology continue to advance.

Right now though, the biggest threat posed by AI? Adding bacon to ice cream or glue to pizzas.

>@themadivlog How did I end up a butter #fyp ♬ The Office - The Hyphenate

The pizza idea is just one of the more egregious suggestions that Google’s AI engineers are now having to manually remove from the search engine’s new AI Overview, rushed out the door to keep up with competitors’ offerings.

Indeed, the shine is very much coming off big AI announcements. Apple’s declaration that its Siri voice assistant would integrate ChatGPT was met with a cool reaction and a fall in the company’s share price. Whilst Microsoft didn’t fare any better with its new Recall feature, which feeds its AI screenshots of user activity, but has been met with derision. And in an interview with The Verge, Google CEO Sundar Pichai clumsily admitted that “hallucination is still an unsolved problem” in Gemini: “In some ways, it’s an inherent feature.”

Aside from the recurring hallucination issue, if AI is to continue on its upward trajectory, energy use will have to be considered – it’s rising fast, with one report saying that, by 2027, the energy consumption of all AI data centres worldwide could be more than the energy used by the whole of the Netherlands.

Nvidia has become the biggest beneficiary of the AI boom, with the firm soaring past Apple to a $3 trillion valuation. Its new Blackwell data centre chip cluster, powered by eight proprietary GPUs, has been dubbed a “doomsday device” in terms of energy consumption – and CEO Jensen Huang foresees millions of them worldwide.

Nevertheless, there are still a great many hurdles to overcome in the AI race – and in the reliability of the underlying software – before we will have an all-AI telco.

5G Standalone

Speaking of tech standards whose promise remains ever just out of reach…

At MWC earlier this year, talk of 5G Advanced stoked the fires that 2024 would at last be the year that 5G delivers on its promise – though we’ve all heard that before.

VMO2 became the second major operator in the UK, after Vodafone, to switch on its 5G SA network, capable of providing 5G coverage to more than 50% of the population – though coverage and take-up are not necessarily the same thing.

Telefónica announced it was moving its 5G Standalone network to AWS in Germany, in the first instance of an existing mobile operator shifting its core network to a public cloud.

Meanwhile, smartphone sales have seen a 4% rebound so far this year, but after the precipitous drops of the previous two years, there’s still some way to go before enough customers even have the right devices to access 5G-quality services.

5G private networks

As public adoption of 5G has remained muted, the driving force behind 5G in 2024 has been private networks. Partnerships have been key to enabling these rollouts, combining networking expertise with business use cases.

T-Mobile’s Business Group set up a private 5G network at golf’s PGA Championship in May, enabling 5G-connected cameras to capture Xander Schauffele’s victory at the tournament (and not Scottie Scheffler’s arrest).

Spain’s Vodafone Business, in partnership with Ericsson, this year announced they will focus on promoting private 5G networks across Spain, its centrepiece being a new 5G SA network at Ford’s EV car factory in Valencia to create “the car factory of the future.”

And in Malaysia, plans for 40 new private 5G networks have been announced, across the manufacturing, oil and gas, logistics and healthcare sectors.

Simplification

We predicted that telcos would prioritise simplifying their products and processes to stay competitive and streamline their businesses. In the age of strained revenues and AI though, simplification has become a byword for job cuts, as telcos seek to recuperate costs by trimming non-core or unprofitable services.

The biggest “simplification” came from Vodafone, which this year has confirmed the sale of its Spanish and Italian units, its latest exit from international markets after similarly quitting Ghana and Hungary in 2023.

Meanwhile, Telstra is cutting a tenth of its workforce this year to simplify its operations and improve productivity, though one bright spot for Telstra customers is that this goes hand-in-hand with the removal of annual consumer price index-linked rises for postpaid mobile plans.

Is AI and automation driving much of this? Not really – only 13% of respondents to a recent OECD survey attributed tech-driven reasons for recent job losses, with much of it the result of worsening revenues and economic uncertainty.

Security

Several major ransomware attacks have already made the news this year; the British Library continues to piece back together its online systems after a devastating cyberattack in October 2023, with many digital archival services still unavailable as of this month.

Christie’s online bidding system was knocked offline in an attack which compromised the details of 500,000 of the auction house’s clients, but even that is small change compared with the details of 560 million customers stolen from Ticketmaster by hackers, made available for purchase on the dark web for $500,000 – almost enough for one ticket to Taylor Swift.

The telecoms industry has been just as exposed; Australian ISP Tangerine suffering a data breach in February, with the full names, dates of birth, email addresses and mobile phone numbers of more than 200,000 customers taken by hackers.

What action is being taken to fight back? In the UK, the Product Security and Telecommunications Infrastructure (PSTI) Act 2022 came into effect in April, requiring “minimum cyber security requirements before consumer connectable products are made available for sale to UK customers.” This means that new devices can no longer be sold with obvious default passwords, like “0000,” “password” and whatnot (also not a recommended password).

Progress? Progress, no doubt, but not enough – and with GenAI to consider now, security legislation and action remains woefully behind the threats.

Satellite communications

The market for satcoms is becoming as crowded as the night skies, as satellites become “increasingly viewed as a pragmatic means of network extension and access to revenue streams.”

This year, both AT&T and Verizon have agreed new partnerships with AST SpaceMobile to provide space-based broadband directly to customers’ devices, though its ultra-bright array of LEO satellites has many fearing it could make dark skies a thing of the past.

Meanwhile, Spanish satellite firm Sateliot is aiming to get the first LEO satellite constellation with 5G standards for IoT, launching four of them aboard a Falcon 9 rocket in July.

And for passengers of Qatar Airways, they will soon be receiving in-flight connectivity from Starlink on its planes, as the firm trials a trio of satellite-connected Boeing aircraft (a company in dire need of some good publicity this year).

However, reports suggest that Starlink’s satellite network could be depleting the ozone layer, and the same solar flares responsible for spectacular auroras across the northern hemisphere also caused some disruption to Starlink’s array:

All @Starlink satellites on-orbit weathered the geomagnetic storm and remain healthy

— SpaceX (@SpaceX) May 13, 2024

In fact, scientists are warning that increasing solar activity could continue to cause severe disruptions to both satellites and ground-based communications infrastructure, perhaps on a similar scale to the Carrington Event of 1859, the most intense geomagnetic storm in recorded history. A similar storm today, it’s warned, could cause damage in the trillions of dollars.

Aggregation & acquisition in the altnet market

Altnets continue to be a major driver of broadband growth in the UK; by the end of the year, it’s expected that the number of fibre-connected households will reach 16.7 million. nexfibre reached one million premises in April, the fastest fibre build of any network in the UK at just 14 months, becoming the second largest competitive network in only its second year of business.

The aptly-named Telecoms Acquisition group, announced that it has agreed to purchase CityFibre’s residential customers from Gigabit Networks, adding to its stable of firms including Home Telecom, Fleur Telecom and Eclipse Broadband.

Meanwhile, CityFibre acquired Lit Fibre in an £80 million deal, the first of five acquisitions the firm hopes to make over the next two years, and Netomnia and Brsk announced their own merger in June. Like the hydra however, new altnets keep springing up, with Beebu launching in June and aiming to reach 16 million homes by August through a network of fibre partnerships.

As the UK’s national fibre infrastructure reaches saturation point (and beyond in some areas), we should see more consolidation going forward, but until that point, expect a few more flash-in-the-pan firms to come and go.

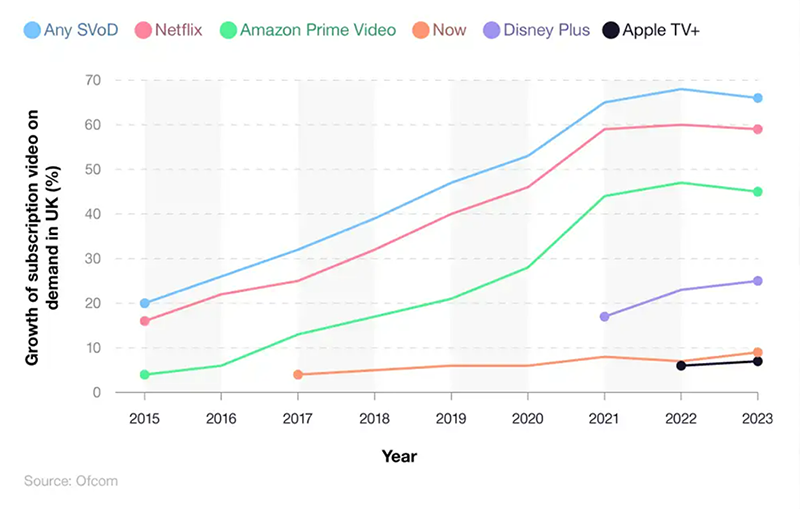

Streaming spend slows

We predicted that 2024 would see a drop in consumer spending on content, but TiVo’s Q4 2023 Video Trends Report found that it was already in decline during 2023 as consumers continued tightening their belts.

Despite this, revenue is up – but only due to price rises and the introduction of ad-supported tiers of membership.

Netflix reported a jump in sign-ups at the start of the year, but this was fuelled in large part by the ending of password-sharing.

For US customers, subscribing to several streaming services will now cost them the same as the much-loathed cable bundle [paywalled]. Rather counterintuitively, to try and entice new customers, this is exactly what streaming providers are leaning into.

Comcast has bundled Apple TV+, Netflix and NBC's Peacock into its Xfinity StreamSaver package. Not to be outdone, Disney and Warner Bros. Discovery are bundling Disney+, Hulu, and (HBO) Max for that elusive customer segment which wants to watch both Moana and The Sopranos.