Top Telecom Trends for 2025

As we stand once more at the beginning of a new year for the telecoms industry, we break down the top trends for 2025, as voted for by our followers on social media.

2025 is poised to be another transformative year for the industry as the telecommunications landscape continues to change at an unprecedented pace and in unpredictable ways.

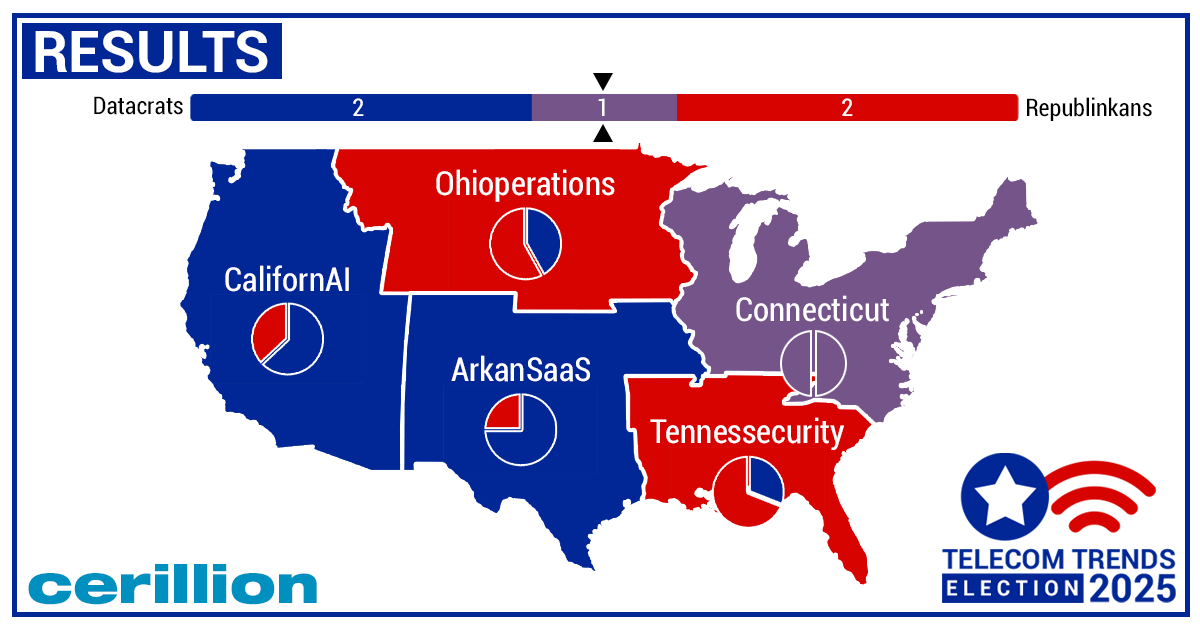

Nevertheless, 2024 saw the most elections ever held across the world, so we decided to add one more to the pile, asking our followers on LinkedIn and X (formerly Twitter) to predict the key trends that will drive innovation, strategy and growth in the telecoms industry in 2025.

This vote took the form of a US election-style vote, with trends competing across five key “states” for the two “parties” – the Datacrats and the Republinkans.

These trends not only reflect technological advancements but also underscore the industry's shifting priorities towards more intelligent, connected and customer-focused solutions.

The final results of voting across the five states were as follows:

|

Datacrats |

Republinkans |

|

|

CalifornAI |

Artificial Intelligence |

Digital innovation |

|

Connecticut |

Satellite connectivity |

Open Digital Architecture |

|

ArkanSaaS |

Digital engagement |

Marketplaces |

|

Ohioperations |

Sustainability |

Customer centricity |

|

Tennessecurity |

Network APIs |

Cybersecurity |

CalifornAI: Artificial Intelligence

It’s been over two years now since the GenAI boom of late 2022. Though the hype is still very much real, this isn’t (yet) translating into the societal-changing forces that many predicted – nay, feared – with only about 6.6% of companies in the US using AI, and it reportedly having next to no economic impact so far.

Our polls reflected this, with AI losing its early lead, and only scraping a narrow victory over digital innovation. However, for a technology that was last year telling people to eat one rock a day, that isn’t a bad performance.

2025 is set to be the year of agentic AI – tools that can autonomously perform tasks on behalf of users. For industries such as telecoms, these could be based on small language models (SLMs) trained on more focused datasets – because why does your customer service agent need to be trained on the complete works of Shakespeare?

Such agents could be actively deployed in businesses this year, according to OpenAI’s Sam Altman; will this be enough to resurrect the financial outlook for the one-time industry darling, which is expected to make a loss of $5 billion this year? The company continues to lose money on its $200-a-month premium plan as other LLMs including Anthropic’s Claude and Meta’s open-source Llama gain ground.

Firms are nonetheless betting the house on the great AI pivot; Meta – unlikely to rebrand itself around another technology again – is recentring its entire business model around Llama, even though the company’s chief AI scientist thinks that the model is “dumber than a cat.”

This hasn’t stopped Meta from debuting a series of AI-generated user profiles on its platforms, until it was discovered that the accounts had been active for much of 2024, but were receiving next to no engagement, and had stopped posting since April, bringing the Dead Internet Theory one step closer to reality:

Never in my career have I seen so many ostensibly consumer-oriented companies invest such vast amounts of time and money into something normal people have, at best, absolutely no interest in https://t.co/6w8bElrzZP

— Sam Biddle (@samfbiddle) January 6, 2025

In fact, for all the much-publicised developments in AI-generated images and video, they have being largely shunned by the public, who’ve christened the reams of low-quality, engagement-seeking material proliferating across social media as “slop.”

AI is enabling CSPs to unlock unprecedented insights from their vast data repositories through machine learning-powered predictive analytics models. For example, T-Mobile US has partnered with OpenAI on one such “intent-driven AI-decisioning platform” to develop targeted marketing strategies, create highly personalised service offerings and predict churn.

Meanwhile, China has been fast catching up in the AI race, but restrictions on exports of critical chip components has stymied progress. Despite these setbacks, start-up DeepSeek has emerged with its latest open-source release, DeepSeek V3, built with 671 billion parameters for little over $5 million, a fraction of the cost of its US-built competitors.

In 2025, CSPs need to focus on delivering meaningful customer use cases rather than more outlets for AI-generated slop, but as a premium value-added extra, like Singtel offering its customers free access to Perplexity Pro AI search.

Connecticut: Satellite communications

Satellite communications emerged neck-and-neck with Open Digital Architecture in the state of Connecticut (more on that shortly).

Investments could top $20 billion this year, according to Analysys Mason, driven by global networks of low-Earth orbit (LEO) satellite constellations providing connectivity to rural and remote areas that traditional infrastructure is unable to cover.

The potential applications are vast, from enabling IoT connectivity in agricultural and industrial settings to supporting emergency communications during natural disasters. For CSPs though, if satellite providers can sidestep them and provide seamless communications at competitive prices, they could vertically integrate the market and pose a massive challenge to existing operators.

SpaceX’s Starlink is likely to be a big beneficiary of founder Elon Musk’s cosy relationship with (re)incoming President Donald Trump. While it remains to be seen what will come of Starlink in the US, Italy is reportedly already in talks to integrate its satellite network into national infrastructure, enhancing its telecom security and digital communication capabilities, while Amazon’s Project Kuiper plans to offer services in the UK, pending approval from Ofcom.

Following a spate of undersea cable severings in 2024, NATO is looking to build out a satellite network to protect its member countries’ connectivity. However, Europe is playing catch-up in terms of its own offering with IRIS² (Infrastructure for Resilience, Interconnectivity and Security by Satellite), and is facing delays, disputes and growing costs of €11.4 billion, just shy of Starlink’s anticipated $11.8 billion revenue for 2025.

Once again, there’s hot competition from firms in China; Chang Guang Satellite Technology Co. has recently achieved a 100Gbps data transmission through satellite-to-ground laser communications with its Jilin-1 satellites, greatly outpacing Western rivals on speed.

So, the satellites are in orbit – how do we communicate with them? Enter D2D (Direct-to-Device), enabling the latest handsets to connect directly without the need for dedicated hardware. SpaceX launched 20 Starlink satellites into Earth's orbit to enable this at the end of 2024:

The first Starlink satellite direct to cell phone constellation is now complete.

— Elon Musk (@elonmusk) December 5, 2024

This will enable unmodified cellphones to have Internet connectivity in remote areas.

Bandwidth per beam is only ~10Mb, but future constellations will be much more capable. https://t.co/wJHMGEzzE4

Telstra is one of the first CSPs to benefit from direct-to-cell text messaging, to cover rural Australia, though the firm was keen to stress this is “really a ‘just-in-case’ connectivity layer” for emergencies.

However, current LEO satellites are unlikely to replace ground-based mobile networks any time soon, having a life expectancy of only 7-10 years. Their coverage also depends on orbit patterns determined by the provider, and will have low overall capacity for connections. As for costs, while developing and low-income countries often see lower prices, these reductions don’t necessarily mean services are affordable, precluding satellite from being a viable connectivity replacement for low-income rural regions.

Connecticut: Open Digital Architecture

Voters were of the opinion that TM Forum’s Open Digital Architecture (ODA) will represent as much of a fundamental shift as satellite communications in 2025.

As CSPs face increasing pressure to modernise infrastructure while maintaining competitiveness, ODA has become essential for driving innovation and operational efficiency by establishing standardised, reusable components that can be easily integrated and modified.

By implementing ODA principles, CSPs are successfully creating more cohesive environments where different components can communicate seamlessly, reducing operational complexity while delivering substantial reductions in expenses through automated processes and simplified integration of new services.

Several major CSPs have already successfully transformed key business processes by “Running on ODA”, including:

- Automated service orchestration across hybrid cloud environments

- Simplified integration of third-party services and applications

- Improved data analytics capabilities through standardised data models

- Enhanced customer experience through real-time service adaptation

Amongst software vendors, there is also a growing number of companies achieving “Ready for ODA” certification, Cerillion included. By aligning with TM Forum’s industry-leading standards, we're ensuring our products are not only future-ready, but also capable of delivering seamless integration, enhanced interoperability and greater agility for our customers.

ArkanSaas: Digital Engagement

Digital engagement has convincingly beaten marketplaces, underlining the importance of self-service customer engagement models, despite growing interest in marketplace solutions.

CSPs are investing heavily in building comprehensive digital ecosystems, focused on creating holistic, personalised digital experiences rather than merely transactional interactions.

2025 will bring further widespread adoption of GenAI in the sphere of customer experience, tailoring solutions from personalised data plans to device recommendations, and integrated experiences that go far beyond traditional telecoms services.

In Omdia’s 2024 Telco Consumer Engagement Survey, 43% of respondents said CSP apps were their preferred means of contacting their broadband or mobile provider for real-time service management, up from 35% in 2023. However, only 33% of CSPs currently offer mobile apps like these.

The digitally-focused CSP of 2025 must adopt composable digital experience solutions to increase customer engagement, make personalised recommendations and offer seamless multi-channel experiences.

Ohioperations: Customer centricity

Customer centricity has decisively outperformed sustainability as a key trend, though it's worth noting that the two are not mutually exclusive. Customers want more granular control over their services, pricing plans and data usage, which means that transparency, flexibility and control are all becoming key differentiators.

CSPs are developing increasingly sophisticated customer segmentation strategies that allow for genuinely personalised experiences that anticipate and exceed customer expectations. The goal will be the development of seamless omnichannel experiences, driving improved loyalty and retention rates using customer feedback and behavioural data to identify pain points and measure customer satisfaction.

The industry is now embracing “zero-touch” experiences; where changing plans might have previously required calling in, visiting a store, or navigating complex online menus, newer systems such as AT&T Autonomous Assistants (AT&TAAs?) analyse usage patterns to suggest optimal plans and offer one-click switches.

Tennessecurity: Cybersecurity

Cybersecurity has emerged as a more critical trend than network APIs, reflecting the increasing complexity and sophistication of digital threats.

CSPs are investing in advanced security technologies including AI-driven threat detection, zero-trust architectures, SIM swap attack prevention and improved customer authentication methods.

Robust security becomes paramount given the rise of – once again – AI, which is enabling bad actors to engage in advanced forms of fraud, including convincing real-time deepfake technology:

… and some less-than convincing ones:

A french woman was scammed out of over $800K by someone pretending to be Brad Pitt

— Culture Crave 🍿 (@CultureCrave) January 14, 2025

• Scammer DM'd her on Instagram and convinced her with AI-generated videos and edited images

• She divorced her husband thinking they would get together

• Scammer convinced her his bank… pic.twitter.com/VWD3RtvIO3

The start of 2024 saw the British Library’s online systems still on their knees following a cyberattack in October 2023, with many services still unavailable over a year later. Meanwhile, in September, Transport for London was hit by a massive cyberattack that saw the details of 5,000 customers compromised, and left others unable to top up Oyster cards online or access refunds; and in November, the Romanian presidential elections were targeted by foreign state actors, leading to the results being formally annulled.

But these incidents pale in comparison to Salt Typhoon, a vast cyberespionage campaign targeting US telcos, allegedly carried out by a Chinese hacking group, which saw the records and metadata of millions of customers from eight CSPs stolen, and the targeting of senior politicians, including Donald Trump and JD Vance. Ironically, hackers were able to exploit legally mandated backdoor systems that are used for wiretapping by law enforcement.

In response, the Cybersecurity & Infrastructure Security Agency (CISA) has published new guidance for telcos, stressing the need to strengthen visibility to “monitor, detect, and understand activity within their networks.” Incoming National Security Adviser Mike Waltz went one step further, saying the US must “start going on the offense and start imposing… higher costs and consequences to private actors and nation-state actors that continue to steal our data.”

In telecoms, enhancing network security and protecting customer confidence through zero-trust principles and proactive resilience will be essential to defending against the evolving cyberthreats of 2025.

Hackers at the (back)door, satellites orbiting overhead, and all roads seemingly lead to domination by big dumb AI – the outlook in 2025 is, once again, precarious, but this seems to have become the default state for the telecoms sector.

The opportunities for the industry to thrive have never been more in reach though, but it’s up to telcos to make meaningful changes to their services rather than taking their begging bowl to Big Tech or hoping that 2020 2021 2022 2023 2024 2025 is the year that 5G will finally start to deliver.

Will this year’s predictions stand the test of time? Check back on the blog in June for our mid-year trend review, or revisit our review of last year’s telecom trends as decided by the Cerillion team.

Update [27/01/2025]: The release of DeepSeek's newest model, DeepSeek-R1 has been described as "AI's Sputnik moment," causing the app to overtake ChatGPT as the most popular GenAI platform and triggering a selloff of shares in US-based AI firms.

Update [30/01/2025]: Vodafone has reported an "historic first" direct-to-device satellite call via Bluebird satellite operated by AST SpaceMobile: